Workers Comp is a kind of accident insurance paid by employers without making any payroll deductions from the employees’ salaries. With this, you can find the information subject to state, local, or federal withholding. The tax and wage summary report shows your employee’s taxable wages and the withheld taxes from those wages.

In the Payroll Tax Payment report, you can see all the payroll tax payments for the selected time period for better tax filing. It summarizes everything which has already been paid for and what needs to be paid for all employees. This report comprises of all the payroll taxes withheld, due, and paid for individual company employees.

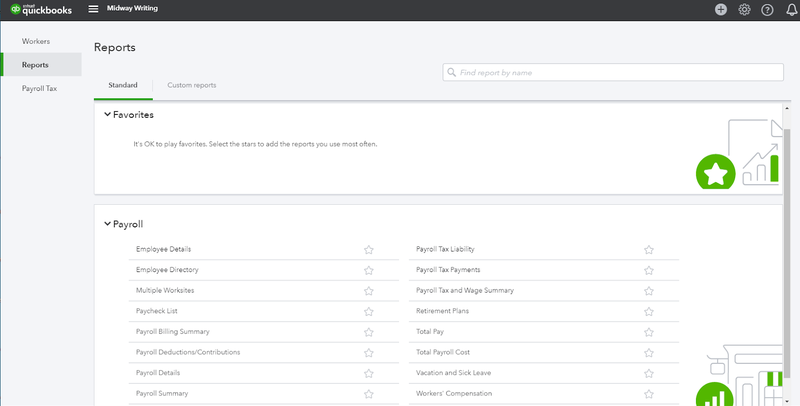

The following reports can help to file your tax forms, employee management, and wages management: a.

QUICKBOOKS DESKTOP PAYROLL RUN SUMMARY HOW TO

Recommended Reading: How to Manage Payroll for Your Small Business? You can use this report to gather the company’s tax filings, cross-check financial data, employee leaves and vacations, payroll details, and more. Reports are vital for human resources and payroll employees for verifying and tracking expenses. This report consists of the summary of the tax amount that was charged to each customer along with the Customer name, location, TIN No., Taxable amount, and more. This report is a summary of the sales tax that you have paid from the taxable sales during the selected time frame. It includes the total taxable/ non-taxable sales, tax rate, collected tax, and sales tax payable.

This report shows the total sales tax balance that your firm owes. With the QuickBooks Vendors and Payables report, you get the summary regarding your sales taxes collected during the period and how much your business owes your tax agencies. This helps you monitor, calculate, and remit the sales tax due. You can run the Sales by Customer and Sales by Vendors Reports to review the sales tax payable generated during the fiscal year as QuickBooks keeps an accurate track of the products purchased or sold. The QuickBooks Sales Reports can be used to give you better insights into your invoices, sales by customers, and sales by representatives. QuickBooks Sales Reportsīills and sales processes are a major part of the tax filing process. Not only that, if you select the Detailed Report, you’ll be able to track the transactions for each customer or vendor, which will give you the largest source of income and expense at once. The Income by Customer and Vendor Summary will help you track down the gross profit and total expenditure from each customer and vendor, respectively, for an efficient tax filing experience. Use the QuickBooks Income and Expenses Report to track down your firm’s gross profit/loss or income/expense over a specific period. The Profit and Loss Detail Report also lists all the transactions over the selected period so you can determine your expenses and revenues.īut, most importantly, the Profit and Loss Year-to-Date report lets you compare the income and expenses to the prior year during the same time period. Moreover, using the Profit and Loss Standard report, you’ll be able to find out if your business was able to make money over the course of time or not. This information can make your tax filing simpler. Use QuickBooks Profit and Loss Reports to get an overview of the business’s profitability over a given time frame.

QUICKBOOKS DESKTOP PAYROLL RUN SUMMARY SOFTWARE

QuickBooks accounting software can be used to track the company’s financial position using the Company and Financial Reports, which can turn out to be very helpful during the tax season. Let’s find out the QuickBooks reports that are required to file taxes: 1. It helps you track down the transactions better and file with precision. Update: This article was last updated on 26th October 2020 to reflect the accuracy and up-to-date information on the page.įiling your own taxes can be nerve-racking, especially when it is last minute, and you’re still figuring out how to put together all your receipts, invoices, bills, and summarize your profit and loss statements of the financial year.Įvery small business owner who is not taking the services of a CPA must know what all documents will be required to file taxes accurately this tax season.īut, if you’re a QuickBooks user, you can use the Accountant and Tax Reports to help you identify your accounting and financial activity throughout the year.

0 kommentar(er)

0 kommentar(er)